Acquisition project | INDmoney

Let’s begin with an elevator pitch -

Designing Acquisition Channel

Channel Name | Cost | Flexibility | Effort | Speed | Scale |

|---|---|---|---|---|---|

Referral Program (Priority 1) | Med | Med | Med | Med | Med |

Content Loops (Priority 1) | Low | High | Med | Low | Med |

Product Integration (Priority 2) | Med | Low | High | Med | Med |

Organic - SEO | Low | Low | High | Low | Med |

Paid Ads | High | Med | High | High | High |

Based on this analysis, INDmoney should prioritize:

- Referral Programs lower customer acquisition costs, boost trust through personal recommendations, attract higher-quality customers, and drive significant growth, as demonstrated by companies like Revolut.

- Content Loops build credibility in financial space and content helps explain complex financial concepts and shows how INDmoney's products fit into users' financial journey

- Product Integration with other financial services creates a seamless experience for users managing multiple accounts and improves discovery and

These channels align with INDmoney's target audience of tech-savvy Indian professionals interested in comprehensive financial management and investing.

A. Where is the market moving towards >

- The data below suggests that while domestic stock investing remains the primary interest for Indian investors, there is growing curiosity about US stock investments, indicating a potential opportunity for platforms offering US stock trading services to Indian investors.

- This data indicates a shifting market dynamic where all-in-one financial platforms like INDmoney are gaining more traction compared to specialized services.

Competitor analysis >

Criteria | INDmoney (Shown for comparison with own) | Vested | Angel One | Traditional Banks and Brokers like ICICI Direct |

|---|---|---|---|---|

Core problem solved | Simplifying personal finance management and investments | Enabling Indian investors to access US stocks | Providing accessible stock trading and investment services | Offering comprehensive financial services and investment solutions |

Products/features/services | - All-in-one financial tracking - Indian and US stock investments - Mutual funds, ETFs, fixed deposits - AI-driven financial advice - Expense tracking and budgeting - Family account management | - US stock investments - Fractional shares - Curated stock collections - Zero commission trading - Educational resources | - Stock trading - Mutual funds - IPOs - Commodities - Currency trading - Research and advisory services | - Stock trading - Mutual funds - Insurance - Loans - Fixed deposits - Research and advisory services |

Target users | Tech-savvy millennials and young professionals (21-45 age group) | Indian investors interested in US markets | First-time investors, traders, and experienced market participants | Diverse range of investors, from beginners to experienced |

GTM Strategy | Blitzscaling approach to rapidly grow user base | Partnerships with Indian brokers and fintech companies | Digital-first approach with a focus on tier 2 and 3 cities | Leveraging ICICI Bank's existing customer base and branch network |

Channels used | Mobile app, website, social media | Mobile app, website, partner platforms | Mobile app, website, physical branches | Mobile app, website, physical branches, relationship managers |

Pricing model | Freemium with premium subscription plans | Commission-free trading with subscription plans for advanced features | Low brokerage fees, subscription plans for premium services | Traditional brokerage model with various fee structures |

Funding | Raised ₹1,145 crore from investors including Tiger Global and Steadview Capital | Backed by Sequoia Capital, Vested has raised over $40 million | Listed company, raises capital through equity markets | Subsidiary of ICICI Bank, capital allocation from parent company |

Brand Positioning | All-in-one super finance app for tracking, investing, and growing wealth | Gateway for Indians to invest in US stocks | Tech-driven, accessible stock trading platform for all | Trusted, full-service financial solutions provider |

UX Evaluation | Clean, intuitive interface with comprehensive financial overview | User-friendly interface focused on US stock investments | Simple, gamified interface designed for mobile-first users | Feature-rich interface catering to diverse financial needs |

Right to Win | Comprehensive financial management with both Indian and US investment options | Specialized focus on US stock investments for Indian investors | Tech-driven, low-cost trading platform accessible to mass market | Full-stack financial services backed by a trusted banking brand |

Learnings for INDmoney | - Focus on specialized offerings like expanding educational content - Leverage partnerships for growth | - Simplify user interface for mass adoption (Explore tier 2 and 3 markets) - Explore gamification elements | - Develop a full-stack financial services ecosystem - Leverage existing banking relationships |

B. Market Sizing

TAM = Total no. of potential customers x Average Revenue Per Customer (ARPU)

Total no. of potential customers = 1.4 billion * 60%(Internet Penetration Rate)* 30%(Potential fintech users) = 252 Mn

TAM = 252,000,000 * ₹500 = ₹126 Billion

Assuming 50% of TAM users are interested in an all-in-one financial app

Target Users = 252,000,000 * 50% = 126 Mn

SAM = 126,000,000 * ₹500 = ₹63 Billion

Assuming the app can capture 5% of SAM users in the near term

IndMoney share of potential users = 126,000,000 * 5% = 6,300,000

SOM = 6,300,000 * ₹500 = ₹3.15 Billion

Other Assumptions:

- India's population in 2025: 1.4 billion

- Internet penetration rate: 60%

- Potential fintech users: 30% of internet users

- Average Revenue Per User (ARPU): ₹500 annually

Customer Research

For customer research, I used a research survey(36 responses) and conduct 8 in-depth interviews with my friends and family.

The Ideal Customer Profiles for INDmoney 🤑:

Criteria | ICP1 | ICP2 | ICP3 | ICP4 |

|

|

|

| |

Name | The Experienced Millennial | First Time Investor | The Family Planners | Affluent Investors |

Description | Professionals who are in the early stages of their career | Fresh graduates or early career professionals | Young parents or couples planning to start a family | Mid- to senior-level professionals or entrepreneurs |

Demographics & Social Characteristics | ||||

Age | 25-30 | 22-28 | 30-40 | 28-50 |

Income level | ₹10-20 lakhs p.a. | ₹6-12 lakhs p.a. | ₹20-40 lakhs p.a. family income | ₹20+ lakhs p.a. |

Demographics | Urban areas, particularly in Tier 1 | Mix of both Tier 1 & 2 | Urban areas, particularly in Tier 1 | Tier 1 |

Where do they spend time | LinkedIn, Instagram, YouTube | Instagram, TikTok, YouTube | Facebook, Instagram, Pinterest, LinkedIn | Instagram, LinkedIn, Twitter, Bloomberg, CNBC |

Interests | Financial independence, tech, fitness | Side hustles, personal growth, tech | Family planning, real estate, fitness | Luxury, travel, business, estate |

Other characteristics |

|

|

|

|

Investment Characteristics | ||||

Investment Knowledge/Experience | Basic to Intermediate | Novice to Beginner | Intermediate to Advanced | Intermediate to Advanced |

Major decision factors/Levers | Financial news, Finfluencers, Peer recommendations, Desk research | Finfluencers, Social media, Word of mouth | Word of mouth/ Peer recommendation, Finfluencers | Financial news/articles, Desk research, Peer recommendations |

Current apps used for investments | Groww, Zerodha, Upstox | Zerodha, Groww, Paytm Money | ET Money, Groww, Zerodha | HDFC Securities, Zerodha, Groww |

Investment goal/motivation | Wealth building, early retirement | Start investing, long-term growth | Secure kids’ future, home ownership | Retirement, wealth preservation |

Preferred Investment Assets | Stocks, Mutual Funds, SIPs | Mutual Funds, SIPs, ETFs | Mutual Fund, SIPs, Real Estate, Gold, FD | US Stocks, Indian Stocks, Deposits, Real Estate, Bonds, Gold |

Primary Need | Simple, intuitive investment tracking | Easy onboarding, educational tools | Family joint planning, tax-saving tools | Advanced wealth management, diversification |

Pain Point | Time constraints, investment confusion Overwhelmed by multiple investment apps - difficult to maintain and track investments across multiple assets and apps | Overwhelm from investment complexity, fear of loss, lack of guidance Don't know where and how to start | Difficulty in managing family finances (goals and expenses), tax-saving, coordinating joint investments with spouse. Need portfolio analysis at family level |

|

Features they're looking for | Easy-to-use interface, automated portfolio tracking, low-cost solutions | Educational content, risk management, easy-to-understand portfolios | Family budget management, tax optimization, joint accounts, goal tracking | Advanced investment options, tax-saving strategies, wealth diversification, Transparency

|

Solution | Simple investment management, automated recommendations, financial literacy tools | Beginner-friendly tools, bite-sized financial education, low-risk options | Family account management, family-oriented investment solutions, tax-efficient planning tools, financial goal-based advice | Advanced portfolio management, tax optimization, personalized financial goal-based advice |

Marketing Pitch | "Invest smart, grow wealth effortlessly, even with a busy schedule." | "Start your investing journey with confidence—easy, fun, and educational." | "Build wealth together, secure your family's future with a seamless financial plan." | "Maximize your wealth with tailored solutions, tax strategies, and premium services." |

Perceived Value of Brand | Convenience, and prefers affordable options, but willing to invest in ease of use | Educational content, simplicity, and low-risk options | Joint financial management and security-focused features | Premium value, associated with personalized advice, exclusive tools, and diversified wealth management options |

Willingness to switch & what will make them switch | High readiness, open to tech-driven solutions & appreciates clear benefits and ease of use | High readiness, highly open to educational, low-risk, user-friendly solutions | Medium-high readiness, open to innovative solutions that align with family-centric financial goals | Low-medium readiness, prefers proven, high-value solutions but open to innovative wealth management & diversification tools |

Money/Time > Money | Med | Low | Med | High |

Approach for selecting ICPs (MECE)

- Already invested

- Invested in only one asset type via one app >

- Responsibility for family > No > No need/motivation to shift platform unless loss of trust

- Responsibility for family > Yes > Track money for family and set goals > FAMILY PLANNERS - ICP3

- Invested in more than one asset type via one app >

- Active/Exploring new ways to invest in new asset classes > SUPER MONEY APP + PORTFOLIO TRACKING(SECONDARY) - ICP1 & ICP4

- Passive/Non-explorer > No need/motivation to shift platform unless loss of trust

- Invested in more than one asset type via multiple apps > SUPER MONEY APP + PORTFOLIO TRACKING(SECONDARY) - ICP1 & ICP4

- Not invested > NEW INVESTOR - ICP2Cutting across - People who specifically want to invest in US/Global market - ICP4

ICP Prioritization

Criteria | Adoption Rate | Appetite to invest/transact | Frequency of Usage | Distribution Potential | TAM (Users) |

ICP 1 - The Experienced Millennial | High | Med | High | High | High |

ICP 2 - First Time Investor | Med | Low | Med | Med | High |

ICP 3 - The Family Planners | Med | Low - Med (Juggling family expenses) | Med | Med | Med |

ICP 4 - Affluent Investors | Med | High | Med | Low | Med |

From the ICP Prioritization Framework, ICP1 clearly stands out and out of the rest, we can see that ICP4 should be focused upon as well since their appetite to transact is on the higher end and money being a crucial factor for a financial investment app. Both also have a very strong use case of the product. Bingo!

Setting up the Context

INDmoney is an all-in-one "super money app" which aims to simplify financial management for Indian users by offering a comprehensive platform for tracking, investing, and growing wealth.

- Founded in 2019 by Ashish Kashyap, a serial entrepreneur who previously founded the Ibibo Group and PayU India

- # Users - 1 crore+

- Features :

🆓 Free Account with zero maintenance charges

🆓 Free Account with zero maintenance charges

🏅Invest in stocks, MFs, ETFs, FDs - all from one place

🤏Start small, build a habit - SIP in stocks with as low as Rs. 10

🌎Invest in US stocks as easy as 1, 2, 3...

🤑Track your net worth and achieve all your investment goals!

What are the users saying [gathered via user interactions(Primary Research) and external platforms(Secondary Research)- App store/Play store, Reddit etc.]

What do they like | What do they don't like |

|---|---|

|

|

Overall, INDmoney appears to be a popular choice for users seeking a comprehensive financial management tool, particularly for those interested in US stock investing. However, concerns about data privacy, customer support, and occasional technical issues are notable drawbacks mentioned by users across various platforms.

Understanding Core Value Proposition

For young, tech-savvy Indian professionals who want to simplify their financial management and grow their wealth, INDmoney is an all-in-one super finance app that provides comprehensive tracking, investing, and wealth management tools in a single, user-friendly platform.

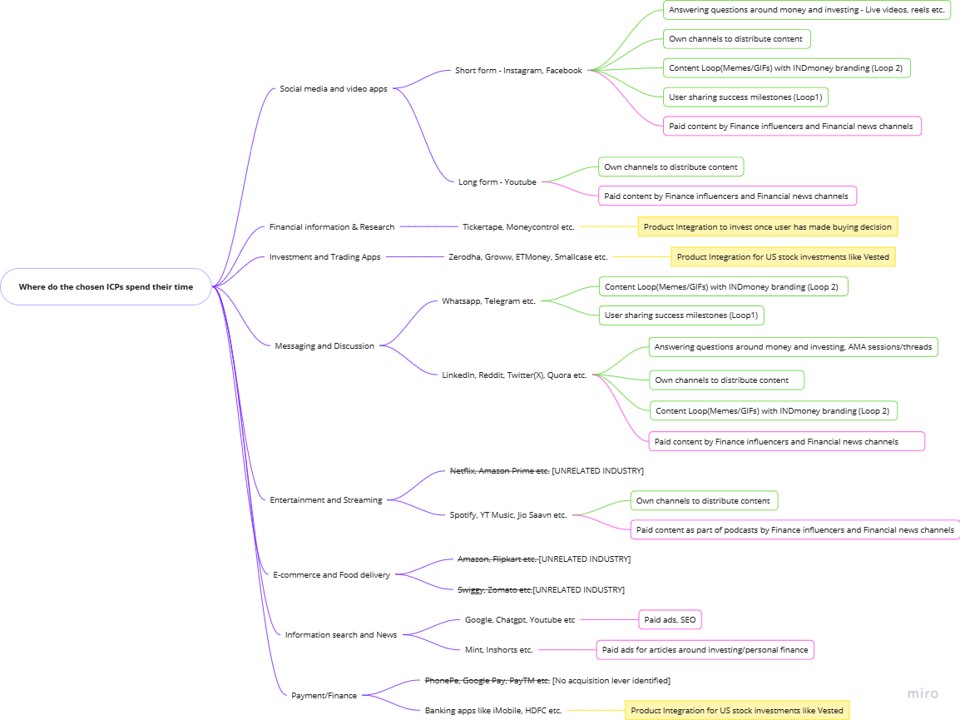

Coming back to where do our ICPs spend their time..

Now focus on the yellow ones, these are the platforms which can be used to integrate with INDmoney to create a natural and smooth customer flow >

Where does organic intent for INDmoney begin

- 🤑 Whenever the user is researching a stock/MF/Deposit or any financial instrument and has/about to reach a buying decision

- Tickertape

- Moneycontrol

- 🌍 Whenever US market scenario's widen and/or user wants to explore diversification and investment into US markets

- Apps which provide avenues for investment but don't offer US-based investment options like zerodha, groww, angel one, banking apps etc.

- 📈 When the user is investing in multiple financial instruments across multiple applications and tracking need arises

Can be found out through integration with Gmail account but not possible to implement to due lack of user consent

Integration | Why beneficial for User + Target ICPs | Why beneficial for INDmoney apart from user acquisition |

|---|---|---|

Stock/Market Analysis platforms like Tickertape/ moneycontrol.com(Markets section) | Since decision already made, they don't have to move out of the platform to place the order Target ICPs - ICP1 | Get users with reduced time to invest by channelizing the intent + Increase awareness for the platform by reaching the huge user base of such apps + Data |

Banking apps or fintech apps which do not have a US-based investment journey feature | Users get to invest in US market and diversify portfolio via their existing app (users who are loyal and don't want a separate app for US investments) Target ICPs - ICP4 | Onboard sticky users onto platform via this integration + Increase awareness for the platform by reaching the huge user base of such apps + Data |

Post-integration metrics to be tracked - #New users acquired via the integration partner, % Click to conversion rate for new user onboarding

Let's look at where do our ICPs spend their time..

Focus on the green ones, these are the platforms which can be used to interact with our audience to achieve our content goals

How can we reach our audience organically, driving intent via the content loops below

Content Loop | Hook | Generator | Distributor | Distributing Channel | Priority(H, M, L) |

|---|---|---|---|---|---|

Success milestones | Financial goal achieved 🚩 [An infographic showing how INDmoney helped the user track and achieve X% of their goal like buying a house etc.] or yearly rewinds | INDmoney's product feature | User | Social media(Share with friends or family groups)/LinkedIn | Medium since social image of bragging might come to mind. ICP3/Family planner is more likely to do this with their core family. |

GIFs on personal finance with INDMoney branding 😄 | Sending GIFs | INDMoney's in-house content team | User |

| Low due to less impact |

Blog | Questions around investments and personal finance on Google/Bing | INDMoney's in-house content team |

|

| Medium since users typically don't turn to google for getting their queries answered |

Podcast | Questions around investments and personal finance answered via industry veterans | INDMoney in collaboration with Fintech influencers | INDMoney's in-house content team | Spotify, YT Music | Medium since the internet is flooded with such content, hence difficult to differentiate |

Answer questions about all things money via AMA Sessions/Personal Finance Threads OR live video/reels | User seeing well-layed out answers from a credible source | Question generated by user but answered by INDmoney expert team |

|

| High since users typically want to discuss regarding money with experienced professionals and gain from their experiences | User insight - People don't know where and how to start and build their investments (Painpoint) |

My Stock/MF Picks | Sharing my knowledge with my social circle will give social validation to the user | INDMoney's product feature which helps user select a stock/MF as "My favorites" and give an option to user to share them with their social circle | User |

| High since experienced investors (ICP1, ICP4) want to share their investment recommendations with their social circle and people also invest on credibility of friends/family |

Loop 1

- Hook - Success milestones - financial goal achieved 🚩 [An infographic showing how INDmoney helped the user track and achieve X% of their goal like buying a house etc.] or yearly rewinds

- Creator - INDMoney

- Distributor - User

- Channel of distribution - Social media, Messaging and discussion apps

In the fintech space, trust is paramount. When existing users refer the app to friends and family, it carries more weight than traditional advertising and when done right, it becomes a powerful, cost-effective tool for customer acquisition in fintech, leveraging trust and credibility through word-of-mouth recommendations.

Tagline for the referral campaign - "Refer & Rise: Elevate Your Finances Together 💸"

A. WHOM WILL YOU ASK FOR A REFERRAL

After going through the user journeys on the INDmoney app, the below ones are identified where the user is experiencing a validated happy moment with a brag worthy element 😎

- US1: When user invests in a US stock and diversifies their portfolio

- Brag worthy element -

- INDmoney helps me invest in US market seamlessly and diversify my portfolio

- Other features - Zero commission trading, Zero forex charges, Increased accessibility via fractional share investments

- Validation of happy moment - Post successful investment, as part of the order success screen

- US2: When user achieves a milestone or a goal or finishes a learning course

- Brag worthy element - INDmoney gives my mind a visual treat, I am able to build and track my goals effortlessly 🚩

- Validation of happy moment - Achievement unlocked

- US3: When user tracks more than 2 asset classes on the dashboard

- Brag worthy element - INDmoney app helps keep me and my money on track | I did not I had accumulated wealth across so many asset classes

- Validation of happy moment - User has tracked >=2 assets in the past and now is adding one more

- US4: After user provides a rating >=4 for the app as part of any user story

B. HOW WILL THEY DISCOVER IT

- User hitting happy moment as part of the user flows designed above

- Dashboard section and after each successful transaction for user who have already hit any of the defined happy moments in the past

- Account section - Let's be honest, everyone is used to it

C. WHY & HOW WILL THEY SHARE

Platform currency - Wallet balance which can only be redeemed via transactions with a limit set for each transaction

Why?

- Correlates with the core value prop - nudges user to invest more and growth their wealth

- User uses platform more via the balance - Yes

- Since it is a money app, it should be linked to money 🤑

Preferred channel to share - Whatsapp

Why? - The ICPs communicate with each other the most via mobile apps with Whatsapp being the primary choice, Telegram second. Also, they would want to actively share it on Whatsapp to specific people(1:1) who are likely to be interested in the world of personal finance and investments.

D. HOW WILL THEY TRACK

Dashboard with clearly outlined stage for each referral and option given to reach out and remind them

E. HOW TO INCREASE AVG. REFERRAL PER USER - THROUGH A TIERED REFERRAL CONSTRUCT

Successful referral - When the referee onboards and transacts on the INDmoney app

Milestones having an exponential reward structure to incentivize referrals 🏁

- One - Rs.200

- Five - Rs. 500 + Rs. 500 worth of your favorite US stock (Ping any FAANG stock of your choice 💸)

- Ten - Rs. 2000 + Rs. 1000 worth of your favorite US stock (Ping any FAANG stock of your choice 💸)

- Twenty+ - Accessory like watch/phone etc.

Offering US stocks as a reward 💰 will give a AHA moment to the user and nudge them to try other core feature of the app + increase loyalty. During one of our user interviews, users mentioned that they would be intrigued to even have small amounts of US investments if they are free > No risk of losing money since it's free + excitement about how this can grow.

Current Referral Construct as shown below is linked to Credit card payments and is not aligned to core value proposition of the product. Also, there was lack of recall for referral incentive during user interviews.

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Abhishek

GrowthX

Udayan

GrowthX

Members Only

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Swati Mohan

Ex-CMO | Netflix India

Members Only

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Nishchal Dua

VP Marketing | inFeedo AI

Members Only

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Abhishek Patil

Co-founder | GrowthX

Members Only

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Tanmay Nagori

Head of Analytics | Tide

Members Only

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

GrowthX

Free Access

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Ashutosh Cheulkar

Product Growth | Jisr

Members Only

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Jagan B

Product Leader | Razorpay

Members Only

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.